School Finance 101

On this page, community members can learn the basics of school finance in Texas. Included is an overview of how districts are funded and where the money goes; definitions of key concepts and common acronyms; and frequently asked questions.

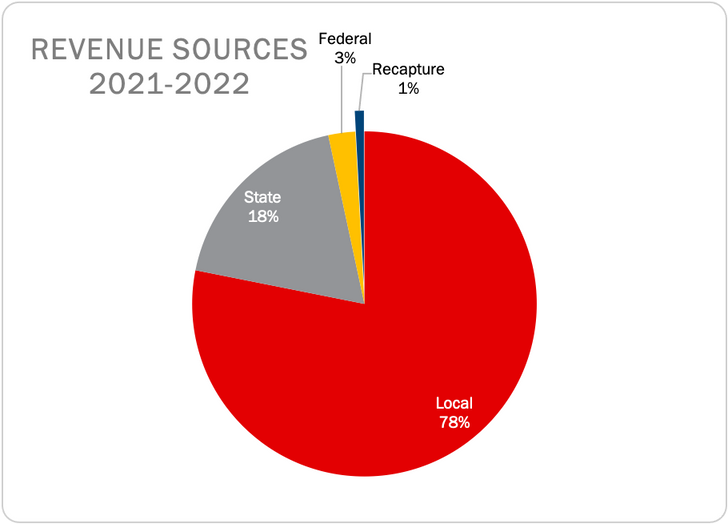

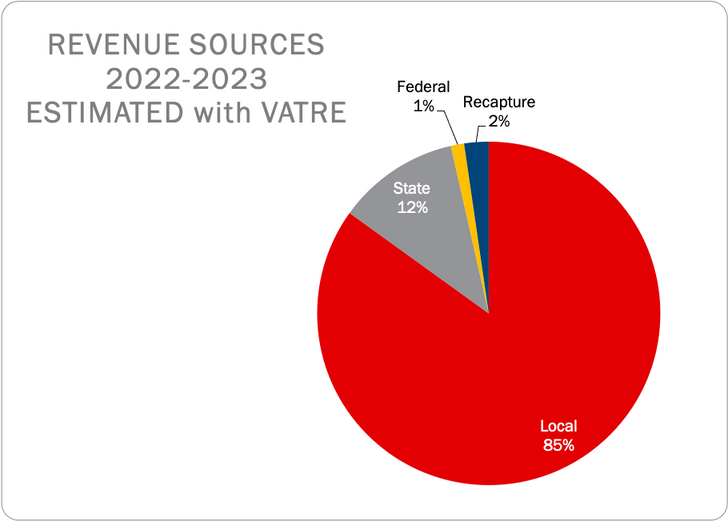

REVENUES

Public schools in the state of Texas are funded from three main sources: local school district property taxes, state funds, and federal funds, with the majority of funding coming from local property taxes collected by school districts and state funds.

The Basic Allotment (BA) is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on their Average Daily Attendance (ADA). The BA is currently set at $6,160 per student, with additional funding based on district and student characteristics. The district’s Tier 1 Entitlement is determined by this Basic Allotment and the characteristics of students in the district.

The Tier 1 Entitlement is covered by a sharing of the state with the local district. The state covers a specific portion from the Available School Fund and then local tax collections are applied to determine whether or not the state contributes additional funds.

- Example 1: If the district’s local tax collections cover the Tier 1 Entitlement, then only Available School Funds are distributed.

- Example 2: If the district’s local tax collections do not fully cover the Tier 1 Entitlement, state funds are received to make up the difference in addition to the Available School Funds.

- Example 3: If the district’s local tax collections cover the Tier 1 Entitlement to the extent that no additional state aid (above Available School Funds) is needed to cover the total cost, then the district is required to send the tax collections exceeding the Tier 1 Entitlement back to the state through the mechanism known as recapture.

This creates a relationship between local and state funds where when local tax collections increase, state funds to a school district decrease.

Local

Local tax dollars make up the majority of the district’s revenue sources. The school district’s board of trustees sets the local property tax rate each year while the county appraisal district determines the market value of property within the county or district.

In an area like Lovejoy ISD where home values are rapidly increasing, even when the tax rate stays the same or is lowered, homeowners will likely see an increase in the total amount of taxes owed due to the higher property values. HB3 requires a lowering of the M&O tax rate in an effort to offset the impact of rising property values; however, the lowered M&O tax rate does not fully accomplish this objective.

State

The amount of state revenue earned each year is determined by the Tier 1 Entitlement calculation and in Tier 2 by the guaranteed yields on the golden and copper penny portions of the tax rate.

When local property tax collections do not fully fund the Tier 1 entitlement, state revenues are earned. When local property tax collections result in more revenues than are necessary to cover the Tier 1 Entitlement, the district sends those excess tax collections to the state through a mechanism called recapture.

In Tier 2, if the golden pennies and copper pennies do not produce the required revenue per student, then additional state revenues are earned. There is no recapture on the tax collections generated by the golden penny portion of the tax rate; however, the copper penny revenue is subject to recapture.

As local tax collections increase, state funds to a school district decrease.

Federal

Federal funding for Texas school districts varies from district to district based on various federal grants and formulas. For the operations of Lovejoy ISD, federal funds in the General Fund equate to less than 1 percent of total revenues and are generated from indirect costs charged to the federal grants and programs related to special education services.

Most federal revenues received by a school district are accounted for in Special Revenue Fund groups and not the General Fund.

*Updated 9/5/2022

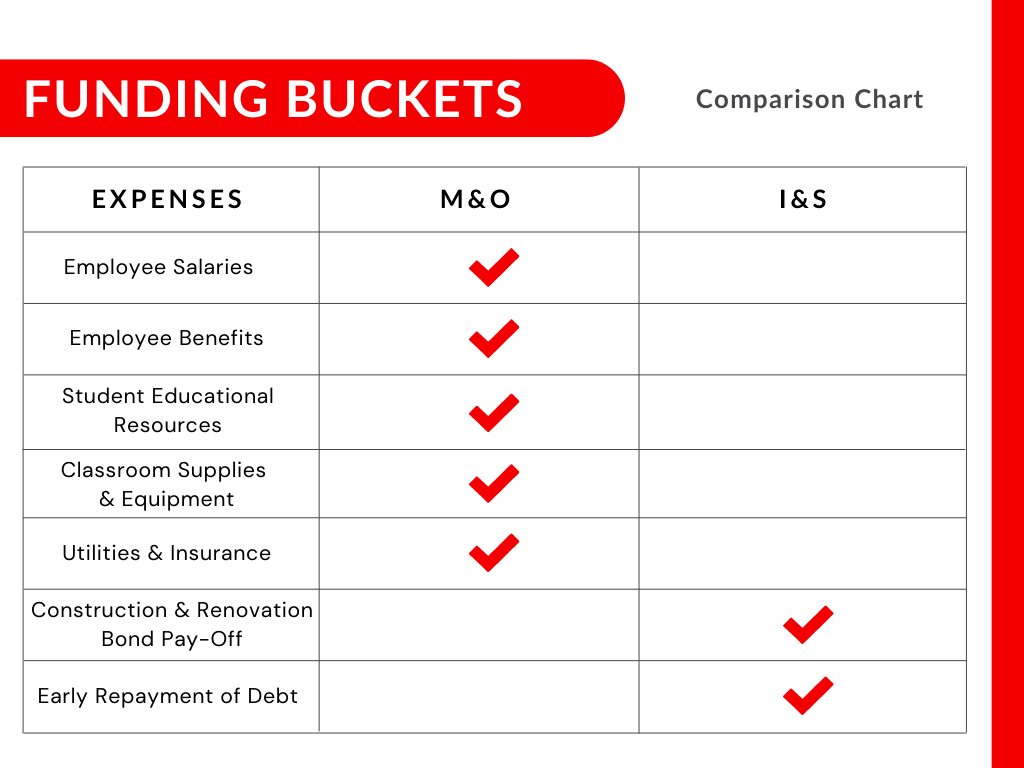

Funding Buckets

School budgets and tax rates are made up of two parts: Maintenance and Operation (M&O) and Interest and Sinking (I&S). The money generated from each part can only be used for specific types of expenses.

Maintenance & Operations (M&O)

Funding coming into this bucket is primarily used for operating the district. Employee salaries and benefits; student educational resources; classroom supplies and equipment; and contracted services – like utilities, insurance, legal and audit services, etc. – are paid from this source of funding.

To relate this to the average community member, this is similar to things like car fuel and routine maintenance, groceries, clothing, cleaning supplies, and utilities like electricity and water.

Compression of the M&O tax rate – or the automatic reduction of the M&O portion of the tax rate introduced as part of HB3 – is meant to limit revenue growth from local property taxes each year. Because of this, an increase in property values does not equal a proportional increase in revenues to the district.

The M&O funding source is split into two tiers: Tier 1 and Tier 2.

Tier 1

The Tier 1 Entitlement is based on the Basic Allotment (BA), as set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). The BA is currently set at $6,160 per student, with additional funding depending on district and student characteristics such as transportation miles/costs and fast growth.

Maximum Compressed Rate (MCR)

A portion of the tax rate that generates revenue to fund the Tier 1 Entitlement. Each year, the MCR is

recalculated by TEA. Compression is based on the comparison of statewide property value growth

and local property value growth, and the extent to which they exceed 2.5 percent.

Tier 2

Funds that enrich the educational offerings a school district provides students – on top of the Basic Allotment, currently set to $6,160 – fall into M&O Tier 2. Examples of these enrichments include small class sizes and specialized programs or courses that go beyond those required in the Texas Essential Knowledge Skills (TEKS). Funding in this tier comes in two forms: Golden Pennies and Copper Pennies.

Golden Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and

is not subject to Recapture, meaning 100 percent of the revenue generated

from this part of the tax rate stays in the district. They are referred to as

“golden” because of their high value to a school district and because state aid

can be generated to fully fund the calculated entitlement.

Lovejoy ISD currently uses all 8 allowable golden pennies as part of its M&O

tax rate.

Copper Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and

can generate additional state aid but is subject to recapture. Current estimates

for 2022-2023 project 69 percent of this revenue would stay in Lovejoy ISD

and 31 percent would be sent back to the state as recapture.

Lovejoy ISD currently uses 5.83 copper pennies as part of its M&O tax rate

and has access to 3.17 more copper pennies through a VATRE. HB3 increased

the copper penny yield to 80% of basic allotment.

RECAPTURE

Recapture is the state’s mechanism for making sure that a district with high property values does not have more funding than districts without those high values.

The state provides more funding to school districts with lower local property tax revenues; less state funding to districts with a strong source of local property tax revenues; and requires districts with the highest local property wealth per student to give some of their local tax revenue back to the state. This latter option is referred to as recapture payments, also known as Robin Hood payments.

The money sent back to the state through recapture comes from money generated from the M&O portion of the tax rate that generates more revenue than that needed to fund the Tier 1 Entitlement or excess revenues generated on copper pennies above the yield.

When a school district’s property values have reached a point where they begin to send money back to the state through recapture, state law requires an Attendance Credit Election – also known as a Chapter 49 Election – for voters to approve the process by which the school district makes these mandatory recapture payments. Lovejoy ISD voters passed an Attendance Credit Election in 1994.

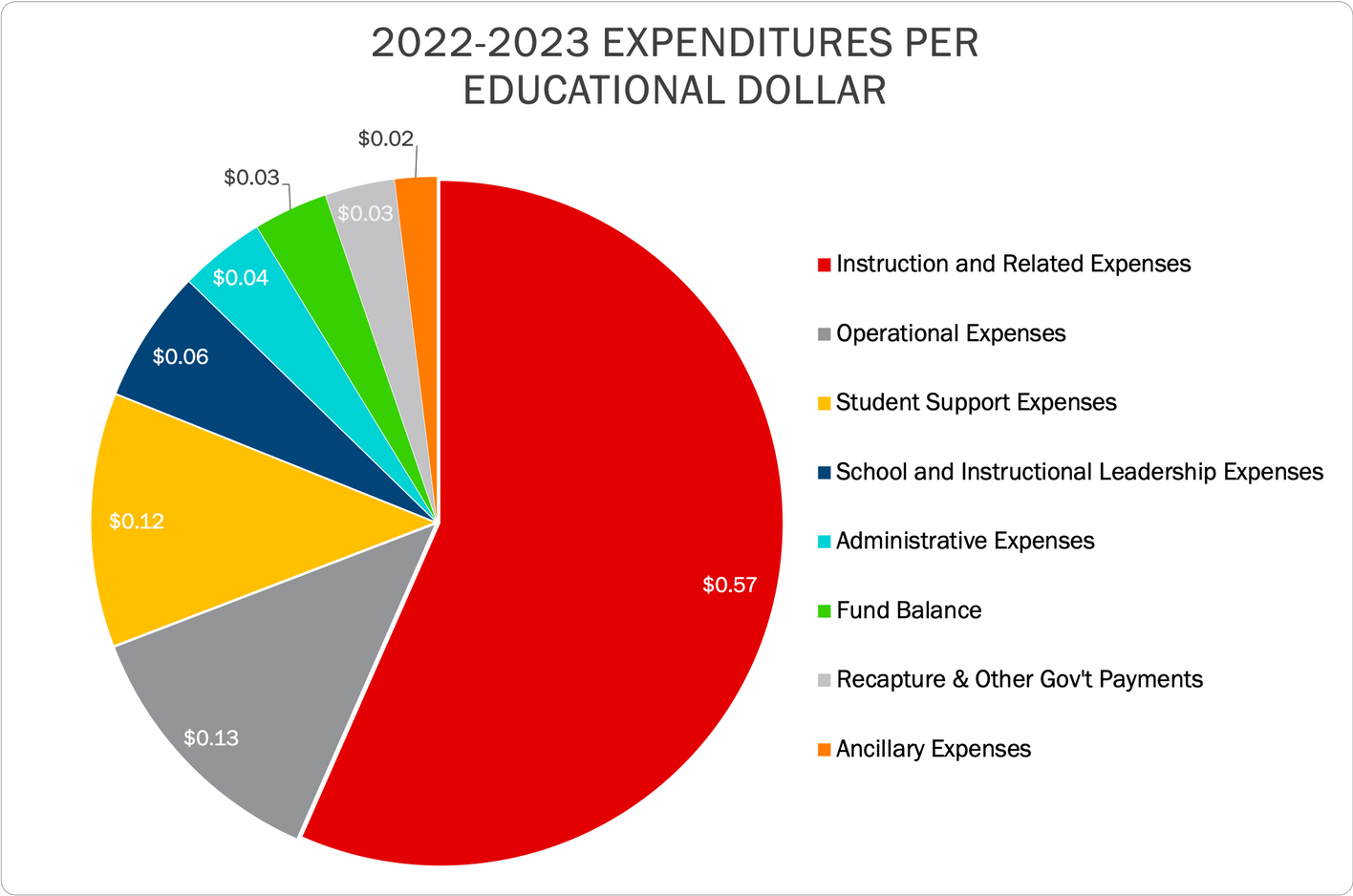

EXPENDITURES

Lovejoy ISD's budget is represented below as a visual breakdown the Educational Dollar. A large portion of each dollar is spent in the classroom on instructional costs.

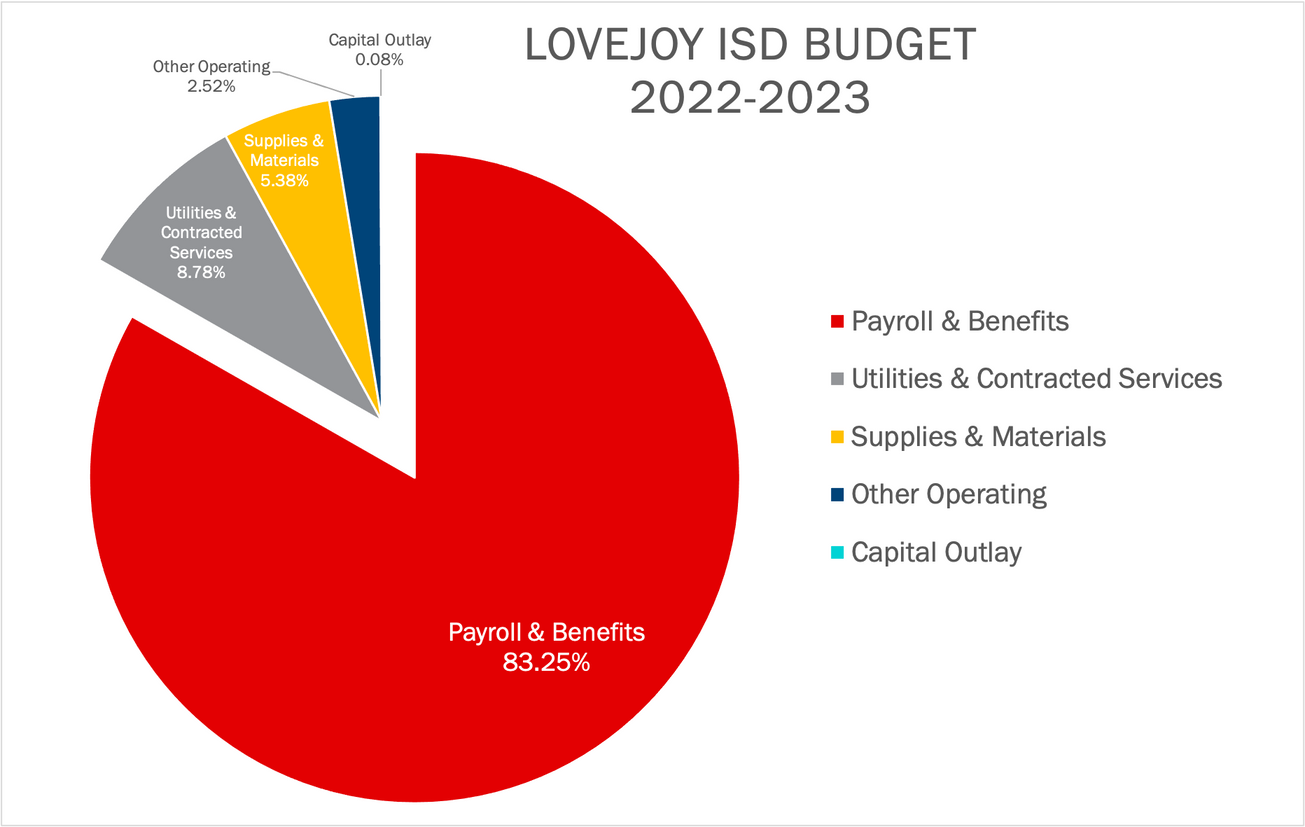

Of Lovejoy's $41,400,000 budget, payroll and employee benefits cost roughly $34,400,000 and account for 83.25% of the budget. This is a large share of the district's operating budget – the funds accessed by the M&O portion of the tax rate. Other expenditures include utilities, contracted services, student educational resources, classroom supplies and equipment, professional development and audit services.

The district's payroll budget includes employer contributions towards employee benefits, as well as compensation for all ≈ 520 employees of the district.

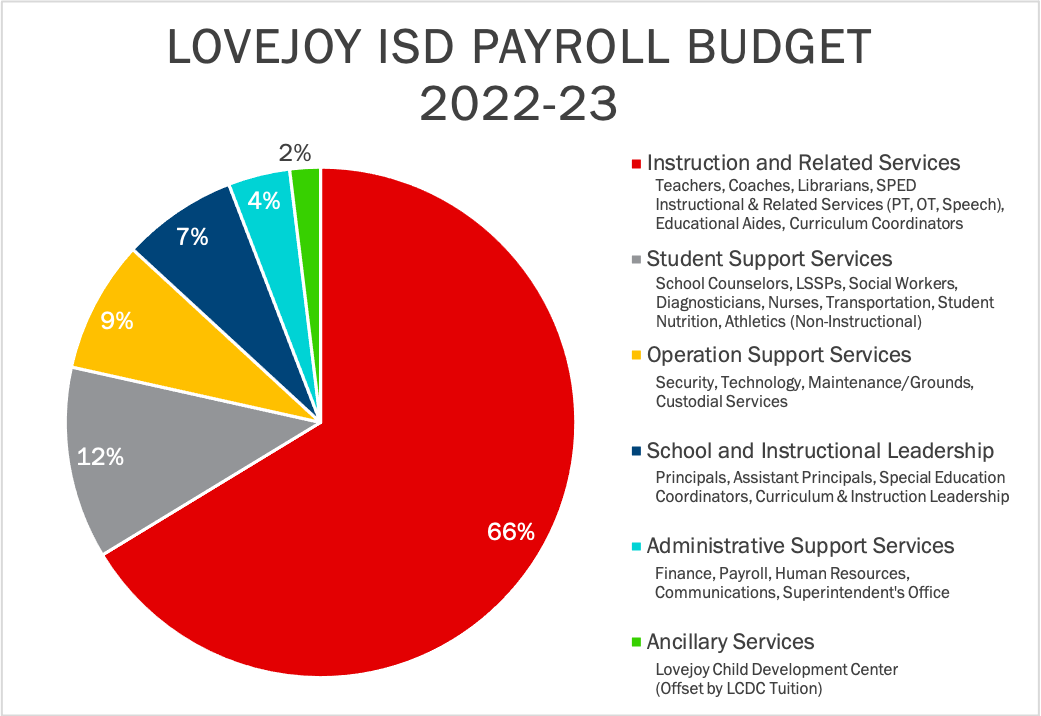

Instruction and Related Services and Student Support Services account for 78% of the payroll budget as depicted below.

FUND BALANCE

A fund balance is like a savings account or emergency account that includes money that school districts do not allocate in budgets and hold in reserve. Fund balance is generated when annual revenues exceed actual operating costs. These funds are used to manage fluctuations in cash flow and to cover unforeseen expenses. Districts with a healthy fund balance also typically earn a higher credit rating because they are viewed as financially sound.

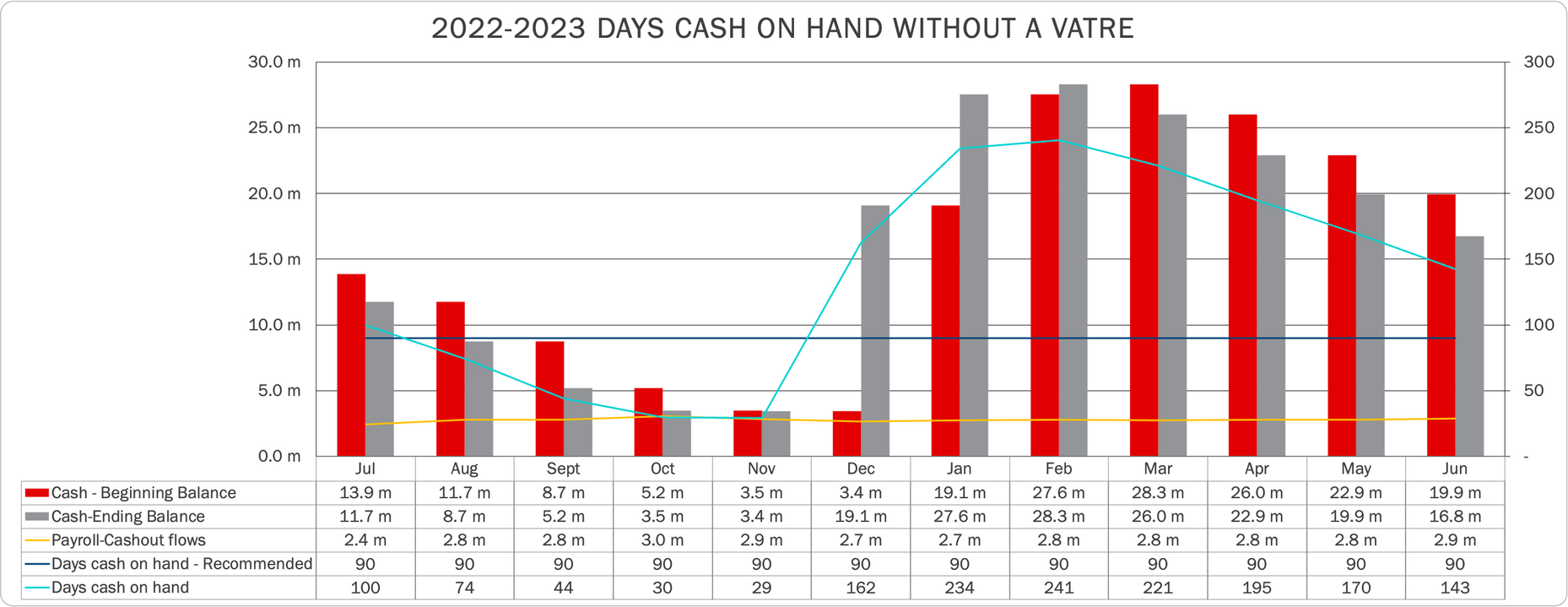

Having sufficient fund balance is especially important in Lovejoy ISD given the fluctuation of cash receipts due to timing of tax collections and our heavy reliance on local tax collections for funding the District. When the school year begins, Lovejoy must be able to fund operations until local property taxes are collected, typically between December and April.

The amount of money in a school district’s fund balance fluctuates throughout the year, but 90 days of cash on hand is often used as a minimum standard. In November 2021, Lovejoy ISD was down to less than 20 days and put steps in place to determine when it may be necessary to secure a loan to make payroll payments.

TAX RATE COMPRESSION

HB3 created a system of funding meant to limit the amount of additional revenue generated from the M&O tax rate on rising property values to approximately 2.5 percent year over year. As a result, as property values grow, a school district is required to reduce the M&O tax rate to meet this 2.5-percent cap. Because of this, an increase in property values does not equal a proportional increase in revenues for a school district.

Tax Rate

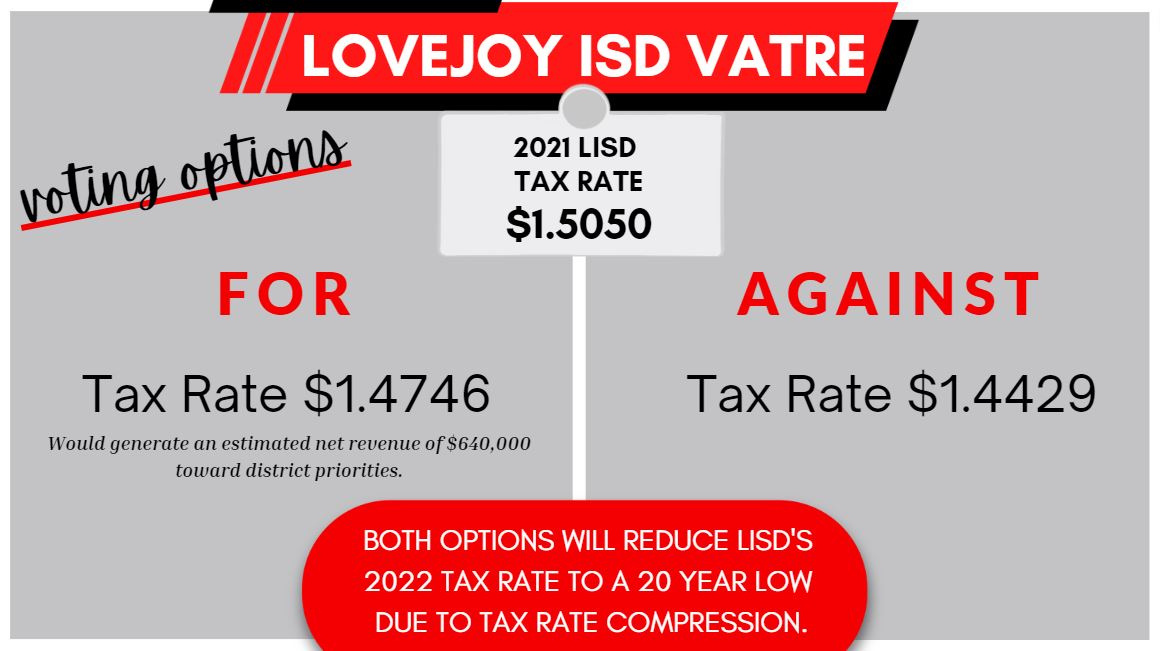

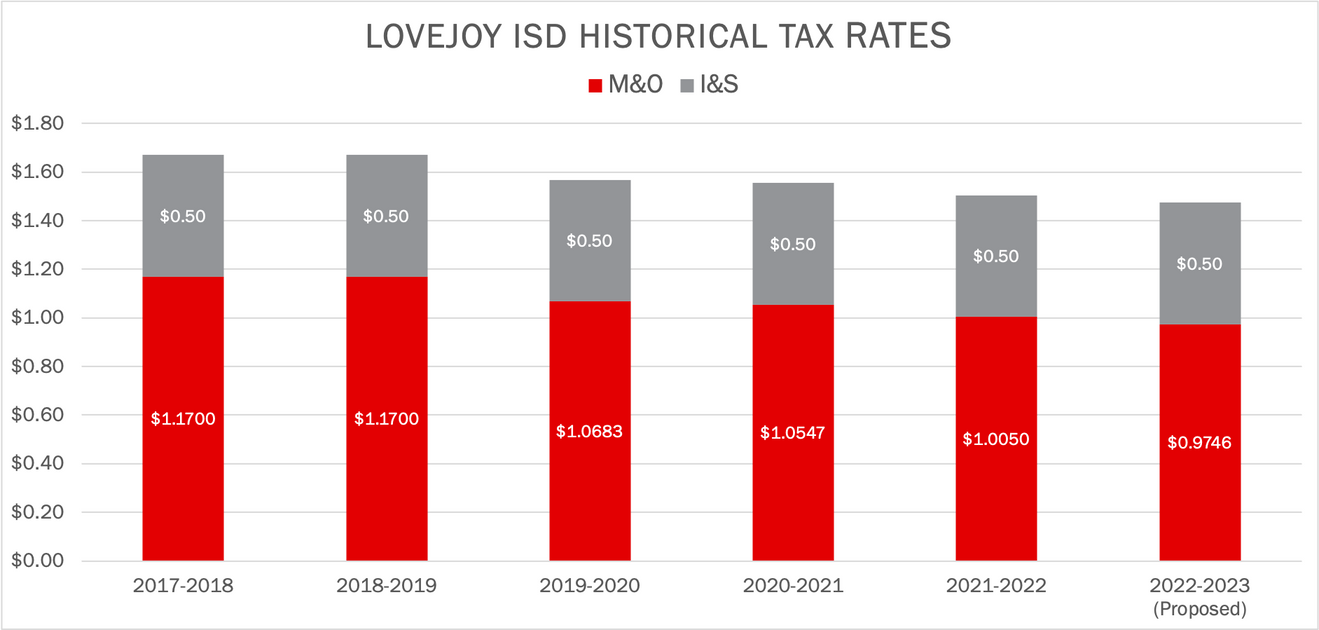

Local tax rates are calculated by adding the M&O tax rate and I&S tax rate together. Due to tax rate compression, Lovejoy ISD's total rate will decline to a 20 year low, even if a VATRE is passed.

VOTER-APPROVED

TAX RATE ELECTION or VATRE

State law requires that school districts seek voter approval to raise their M&O tax rate above a rate set by state law.

The Lovejoy ISD Board of Trustees adopted a tax rate that is greater than the calculated rate set by law, which triggered an election called a Voter-Approval Tax Rate Election (VATRE), which is held on the uniform election date (November 8, 2022).

If the voters do not approve the measure, then the M&O tax rate reverts to the maximum rate allowed under state law.

For additional information on the VATRE Election details, please visit Step 3 - VATRE Details (Coming Soon).

ACRONYMS & DEFINITIONS

Available School Fund (ASF)

All Texas school districts are entitled, under the Texas Constitution, to receive a designated amount from the state of Texas' Permanent School Fund. ASF distributions go toward a district's Tier 1 Entitlement and are based on the district’s prior year average daily attendance (ADA).

Average Daily Attendance (ADA)

Average Daily Attendance (ADA) is the number of students in average daily attendance or the sum of attendance for each day of the minimum number of days of instruction.

Basic Allotment (BA)

The Basic Allotment (BA) is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). The BA is currently set at $6,160, with additional funding depending on district and student characteristics.

Copper Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and can generate additional state aid but is subject to Recapture. Current estimates for 2022 project 69 percent of this revenue would stay in Lovejoy ISD and 31 percent would be sent back to the state as recapture.

Expenditures

Expenses or spending within a governmental entity – like a school district – are referred to as expenditures. Expenditures represent the spending of money.

Fund Balance

A fund balance is like a savings account or emergency account that includes money that school districts do not allocate in budgets and hold in reserve. Fund balance is generated when annual revenues exceed actual operating costs. These funds are used to manage fluctuations in cash flow and to cover unforeseen expenses.

Golden Pennies

A portion of the tax rate that brings in revenue above the Tier 1 Entitlement and is not subject to Recapture, meaning 100 percent of the revenue generated from this part of the tax rate stays in the district. They are referred to as “golden” because of their high value to a school district and because State aid can be generated to fully fund the calculated entitlement.

Hold Harmless

The Basic Allotment (BA) is set by the Texas legislature, guaranteeing every school district a certain amount of funding for each student based on the Average Daily Attendance (ADA). Based on this formula, the number of students in average daily attendance is directly connected to the amount of revenue a school receives.

House Bill 3 (HB3)

House Bill 3 is a bill passed by the 2019 Texas Legislature.

Interest and Sinking (I&S)

The Interest and Sinking (I&S) part of the tax rate. Dollars from this portion of the rate can only be used to pay down existing debt. These tax collections cannot be used for operations, such as increasing teacher salaries or to build facilities.

Maintenance and Operations (M&O)

The Maintenance and Operations (M&O) part of the tax rate. Dollars from this portion of the rate are used toward expenses like payroll, utilities, supplies and transportation.

Revenues

The income of a governmental entity – like a school district – received from taxation and other local, state and federal sources. Revenues are used to finance the services provided to its citizens.

Voter-Approval Tax Rate Election (VATRE)

Voter-Approval Tax Rate Election (VATRE): State law requires that school districts seek voter approval to raise their M&O tax rate above a prescribed amount.

If the board adopts a tax rate that’s greater than the calculated rate set by law, that triggers an election called a Voter-Approval Tax Rate Election, which is held on a uniform election date (November). If the voters do not approve, then it reverts the M&O rate to the maximum allowed under state law.

Weighted Average Daily Attendance (WADA)

Weighted Average Daily Attendance (WADA) is an adjusted student count taking into account student and district characteristics by which students in certain programs are “weighted” to generate additional funds.

FREQUENTLY ASKED QUESTIONS

What was the 2021 LISD tax rate?

Lovejoy ISD had a 2021 total tax rate of $1.5050. The tax rate is made up of two parts. The 2021 M&O portion was $1.0050 and the I&S portion was $0.5000.

What is the 2022 LISD tax rate?

The 2022 proposed LISD total tax rate is $1.4746.

Why does the 2022 tax rate decrease with or without passing of the VATRE?

If the VATRE passes, the tax rate will be $1.4746. If the VATRE does not pass, the tax rate will be $1.4429. The decrease is due to tax rate compression. LISD's 2022 tax rate will be at a 20 year low due to tax rate compression.

How do rising property values impact the district?

Rising property values generate additional tax dollars; however, not all of those tax dollars are retained by the district. As part of the state funding formula, when local tax collections increase, state funds to a school district decrease. Excess tax collections are sent back to the state through recapture.

Why has a VATRE been called?

Without a VATRE, the annual budget is projected to reach a deficit of over $2.1 million by fiscal year 2026. Additionally, without the passing of a VATRE, days of operating expense in the fund balance are projected to decrease to 65 days in fiscal year 2026, potentially requiring a loan to fund operating expenses. The amount of money in a school district’s fund balance fluctuates throughout the year, but 90 days of cash on hand is often used as a minimum standard.

How much additional revenue would the VATRE generate?

The VATRE would generate approximately $640,000 in additional revenue for Lovejoy ISD.

What are the VATRE priorities?

Financial priorities include supporting employee compensation and helping restore the fund balance.

What has the district done to navigate these financial challenges?

The projected budget deficit requires LISD to both look for ways to decrease expenditures while also increasing revenue. Financial sustainability measures taken include implementation of a stakeholder-based Financial Sustainability Committee, zero-based budgeting, as well as reducing and reorganizing personnel. A more comprehensive list of financial sustainability measures can be found in the section labeled Step 2.

I’m over 65, how will the VATRE impact my LISD tax rate?

If you are over 65 and have applied for and received the appropriate homestead exemptions, approval of the VATRE would not impact your tax rate.

If I have questions about tax rates for my property, who should I contact?

More information on the tax rates and exemptions can be found here.